43 alabama state retirement

Alabama Retirement Tax Friendliness - SmartAsset Are other forms of retirement income taxable in Alabama? Some types of retirement income are taxed in Alabama. Income from retirement accounts like an IRA or a 401(k) will be taxed as regular income at Alabama’s state income tax rates. These rates range from 2% to 5%. However, Alabama does not tax income from pensions. Alabama state retirees could get $300 bonus in 2022 under ... Nov 29, 2021 · Legislation sponsored by Sen. Del Marsh, R-Anniston would provide a one-time bonus of at least $300 to state employees, depending on their length of service. Those who retired before March 1, 2022 would be eligible. The bonus would also be available to retirees of local governments who have opted into Retirement Systems of Alabama, though those ...

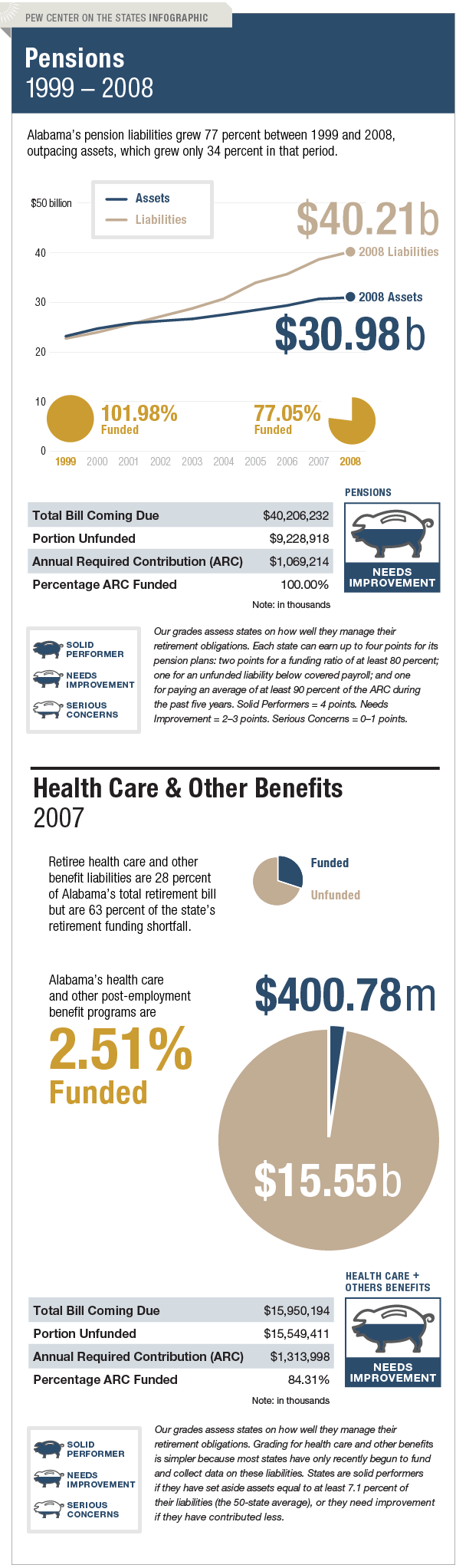

Alabama Retirement System | Pension Info, Taxes, Financial Health Nov 28, 2018 · Each state has a retirement system, but they vary in size and complexity. The organization that runs the systems in Alabama is called the Retirement Systems of Alabama. According to a 2017 report, there are more than 300,000 people participating in the state’s retirement plans and they earned about $3 billion worth of benefits in 2017.

Alabama state retirement

The Retirement Systems of Alabama The Retirement Systems of Alabama We are the safe keepers of pensions for thousands of Alabamians and we take our jobs seriously. It is our goal to seek and secure the best investments and services for our membership, and to ensure that we do everything possible to help our members prepare for and enjoy a successful retirement. CONSTITUTION OF ALABAMA 1901 Constitution Of Alabama 1901. Article I Declaration of Rights. Ratification. Section 1 Equality and rights of men.. Section 2 People source of power.. Section 3 Religious freedom.. Section 4 Freedom of speech and press.. Section 5 Unreasonable search and seizure; search warrants.. Section 6 Rights of persons in criminal prosecutions generally; self-incrimination; due process … ALABAMA STATE PERSONNEL BOARD ALABAMA STATE … The State of Alabama Deferred Compensation Plan offers you powerful tools to help 2.50 w 4.50 w you reach your retirement dreams. This Plan allows you to save and invest extra money . for retirement. You will be able to save and invest consistently and automatically, choose

Alabama state retirement. Can Employees Borrow From State Of Alabama Retirement System ... Feb 01, 2022 · Disbursing the funds from your retirement account negates your lifetime benefits and all the years and months of service you have received. Do You Have To Work 20 Years To Get A Pension? (figure 2) For about half of the existing employer-funded public pension plans administered by state governments, employees work at least 20 years before being ... Is Alabama a Good State to Retire In? | Acts Retirement According to Kiplinger.com, Alabama is the “most tax-friendly” state in the country. Social security benefits, payments from pension plans, and income from the federal government are all exempt. Seniors will be delighted to know that Alabama does not have an inheritance or estate tax. Existing Alabama homeowners age 65 and older are also exempt from the state portion of property taxes, and may also be exempt from federal taxes depending on income. A handy tool to predict what taxes you can expect to pay while living in Alabama can be found on SmartAsset.com. Active Members | The Retirement Systems of Alabama Active Members. Begin saving more money for later while saving taxes now with RSA-1. Any public official or employee of the state of Alabama or any political subdivision of the state is eligible to enroll, regardless of age or participation in the RSA. Frequently Asked Questions - SPD - State of Alabama ... State Personnel 300 Folsom Administrative Building 64 North Union Street Montgomery, Alabama 36130-4100 You may request to have your school, or a third-party transcript service send your transcript directly to State Personnel Department at transcripts@personnel.alabama.gov.

How To Calculate Alabama State Retirement? – Ozark Feb 01, 2022 · Is Alabama A Good State To Retire To? Ranking sixth among states in the U.S. when it comes to retirement security is Alabama. Although there is a mild winter, a wide choice of beaches, and a vibrant golf season, Alabama’s per capita income is 13% lower than national averages. ALABAMA STATE PERSONNEL BOARD ALABAMA STATE … The State of Alabama Deferred Compensation Plan offers you powerful tools to help 2.50 w 4.50 w you reach your retirement dreams. This Plan allows you to save and invest extra money . for retirement. You will be able to save and invest consistently and automatically, choose CONSTITUTION OF ALABAMA 1901 Constitution Of Alabama 1901. Article I Declaration of Rights. Ratification. Section 1 Equality and rights of men.. Section 2 People source of power.. Section 3 Religious freedom.. Section 4 Freedom of speech and press.. Section 5 Unreasonable search and seizure; search warrants.. Section 6 Rights of persons in criminal prosecutions generally; self-incrimination; due process … The Retirement Systems of Alabama The Retirement Systems of Alabama We are the safe keepers of pensions for thousands of Alabamians and we take our jobs seriously. It is our goal to seek and secure the best investments and services for our membership, and to ensure that we do everything possible to help our members prepare for and enjoy a successful retirement.

0 Response to "43 alabama state retirement"

Post a Comment